How can my wealth be managed?

This question has many right and wrong answers. Simply put, you’ll get a different answer to this question depending on who you ask. However, the right answer for you, specifically, will always be different than the right answer for someone else. Each person or family’s financial situation is significantly different than everyone else’s.

Our goal at Sculati Wealth Management is to help you reach the right answer for your life. While you may not engage our services directly, we sincerely hope you find some value in what you read here. The wealth management world is a confusing one, with many different players with vastly different goals. Over the next series of posts, we will walk you through some of the ways that your wealth can be managed.

So, what exactly does it mean when you ask, “How can my wealth be managed?” This question is meant to address the money that you save, over and above what you need to live on a day-to-day basis, and what you should be doing with it. Although it may seem like a straightforward question, there are some key terms to discuss to avoid confusion.

Let’s boil this down to the two major portions of the above question, wealth, and management. When you hear the word wealth, think of a savings account, a 401k, a 529 plan, or Individual Retirement Accounts (IRAs)[1]. The money in these accounts is meant to be untouched for a longer period, typically a year or more. The accounts are most commonly tied to a specific goal such as buying a house, retirement, or higher education, if you have younger children.

When discussing the portion of the question dealing with management, sometimes it’s not so cut-and-dry. With so many different account types and parties involved, how do you know who to speak to, and when to speak to them? There are taxable accounts, tax-deferred accounts, tax-free accounts, and all types in between. There are investment advisors, insurance agents, annuity salespersons, estate planners, and a myriad of other professionals who could assist you in managing your wealth. The number of accounts and people to talk to can be overwhelming, but it’s not always about who you speak to and what account to open. Most importantly it’s when you speak to them about your wealth and your future goals that surround it.

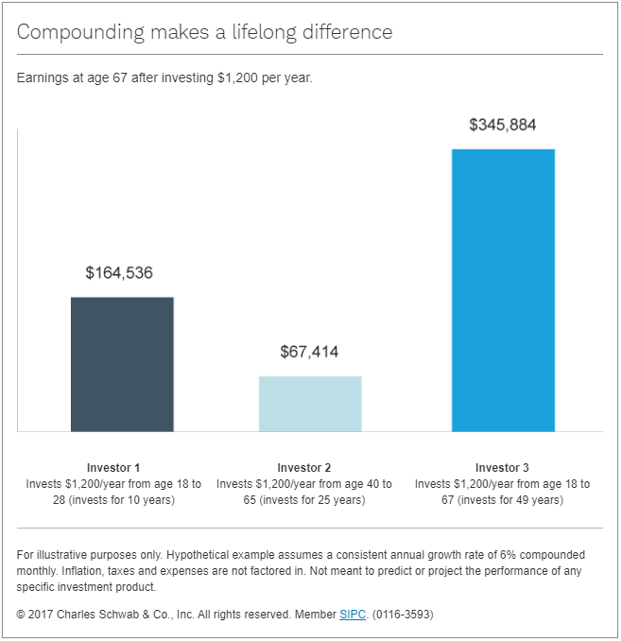

The best time to start talking to someone who can manage your wealth is when you are beginning to save for a goal, whether that’s saving for a home purchase, saving in your 401k for retirement, or just setting aside money for some unknown future goal. Investing wealth is most effective if it’s done over a long period of time, so it’s best to start as soon as possible. Even if you only have a few extra dollars a month to invest, starting early allows for compounding to be most effective.

Compounding is the concept of earning dividends and interest, reinvesting them, and earning additional dividends and interest on them. As the account earns more and more dividends and interest compounding allows for the dividends and interest received to grow as well. This is commonly referred to as exponential growth.

Here is a good illustration of how compounding works:

Source: https://www.schwabmoneywise.com/public/moneywise/essentials/benefits_of_compound_growth

A common reason people don’t start investing early is this whole world of new and confusing terminology that comes with the territory. Add in a story or two about criminals stealing money from investors along with potentially outrageous fees, and the average person just decides to just go at it alone. The apprehension is understandable, however, as in most industries, a few bad apples don’t represent the entire orchard. A later post will dive into some of that terminology, and we will also provide some ways to check on the advisor and fees before you decide to invest your money with them.

At this point you may be asking yourself, “What should I look for when hiring a wealth management professional, such as an advisor?” In our next post we will highlight some of the professionals you may come across and things to look for as a savvy investor.

[1] Other non-financial assets fall under this definition include a home, automobiles, boats/RVs, or collectibles. These will be excluded from the rest of the discussion.